NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

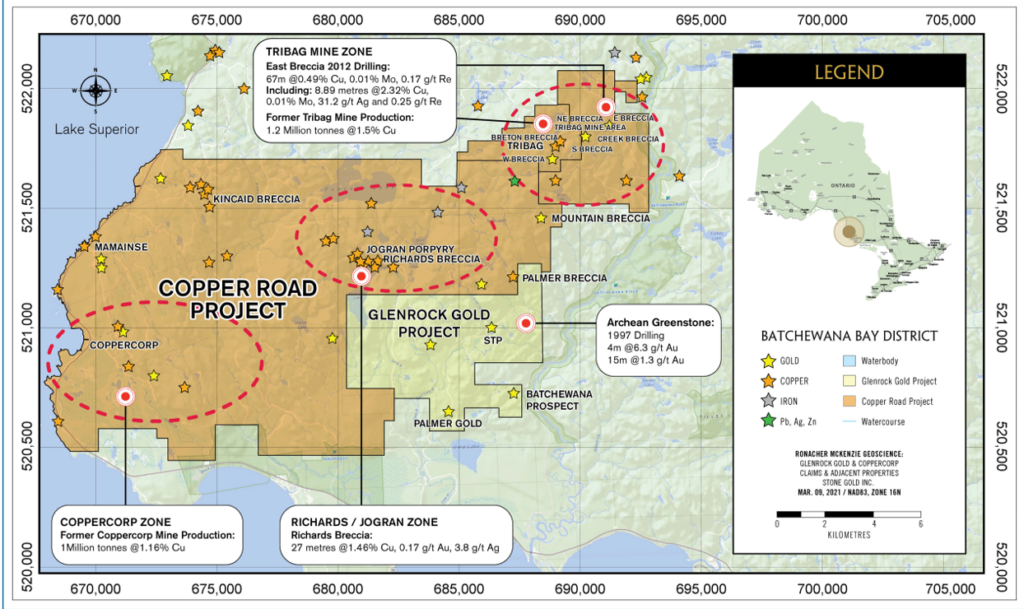

TORONTO, ONTARIO – October 13, 2022 – Copper Road Resources Inc. (TSX-V: CRD) (“Copper Road” or the “Company”) is pleased to announce results of the spring/summer diamond drilling campaign at the Tribag Mine Zone located on its 21,000-hectare Copper Road Project, approximately 80 km. north-west of Sault Ste. Marie, Ontario, Canada.

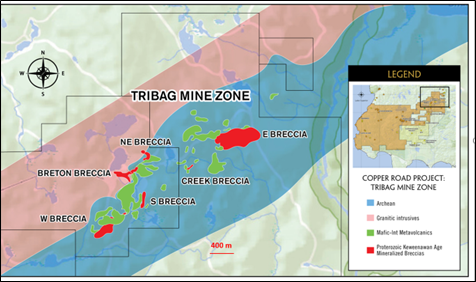

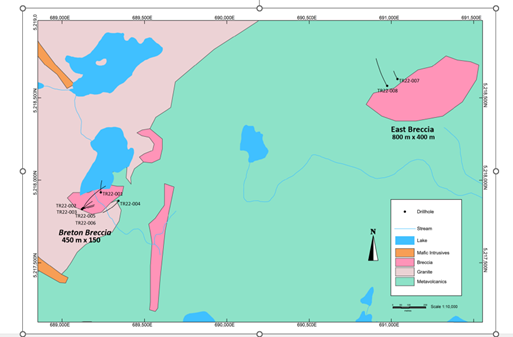

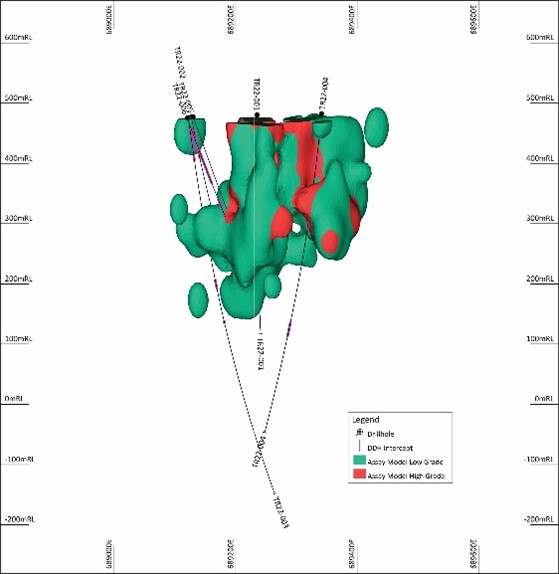

The company completed 3,000 metres of diamond drilling at the Breton and East breccias located within the Tribag Mine Zone (See Figure 1)

Highlights:

All 8 holes drilled at the Breton and East breccias intersected significant intervals of near-surface mineralization that proved continuity, depth and additional mineralization outside of historical assay models.

Notable intersections include:

Breton Breccia:

Hole #TR22-006:

- 100.39m at 0.32 % Cu and 2.99 g/t Ag (0.35% CuEq) from 18m to 118.39m

- Including: 30m at 0.58 % Cu and 4.39 g/t Ag (0.62% CuEq) from 46m to 76m

- Including: 7m at 1.02 % Cu and 8.39 g/t Ag. (1.09% CuEq) from 49m to 56m

- Including: 5m at 1.11% Cu and 4.69 g/t Ag (1.15% CuEq) from 71m to 76m

- 18.43m at 0.29 % Cu and 0.90 g/t Ag (0.30 % CuEq) from 145.57m to 164m

Hole #TR22-003:

- 60m at 0.29 % Cu and 3.19 g/t Ag (0.32% CuEq) from 16m to 76m

- 3m at 1.08 % Cu and 2.06 g/t Ag (1.10% CuEq) from 302m to 305m

East Breccia:

Hole TR22-008

- 48.60m at 0.27% Cu, 4.84 g/t Ag, 0.01% Mo, 0.25 g/t Re (0.37% CuEq) from 34m to 82.60m

- Including: 14.80m at 0.46% Cu, 9.97 g/t Ag, 0.01% Mo, 0.20 g/t Re (0.60% CuEq) from 45m to 59.80m

- 9m at0.60 % Cu, 6.83 g/t Ag, 0.15% Mo, 0.56 g/t Re (1.47% CuEq) from 330m to 339m

- Including: 5.22m at 0.87% Cu, 9.38 g/t Ag, 0.26% Mo, 0.95 g/t Re (2.35% CuEq) from 333.78m to 339m

Hole TR22-007

- 66m at 0.22% Cu, 2.94 g/t Ag, 0.02% Mo, 0.36 g/t Re (0.36% CuEq) from 69m to 135 m

- Including: 11m at 0.31% Cu, 4.04 g/t Ag, 0.05% Mo, 0.87 g/t Re (0.63% CuEq.) from 102m to 113 m

John Timmons, President/CEO and Director, comments, “Our goal with this drill program was to deliver near-surface copper mineralization only 20 kilometres off the Trans-Canada highway. We believe our first drill program into our flagship property is just the start of reviving this historical mining district and clearly demonstrates that there is more copper to be mined. We believe that with systematic exploration across our 21,000-hectare project, the Copper Road project will continue to prove itself as a future source of domestic copper to contribute to the clean energy transition.”

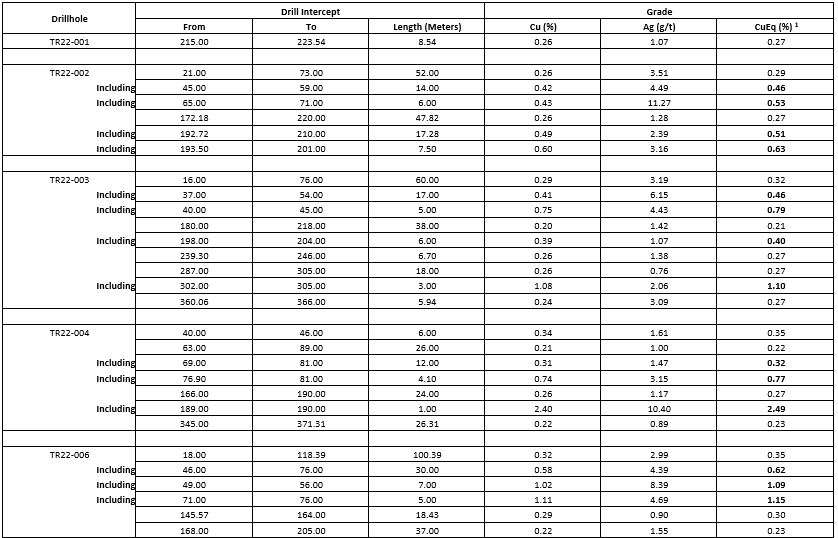

Breton Breccia Drilling Results

¹ Assumptions used in USD for the copper equivalent calculation are metal prices of $3.45/lb Copper, $20.54/oz Silver

and recovery is assumed to be 100% as no metallurgical test data is available. The following equation was used to

calculate copper equivalence: CuEq = Copper (%) + (Silver (g/t) x 0.0087)

Breton Breccia mineralization established from this drill program is hosted in an intensely altered polymictic breccia. The dominant alteration assemblage related to mineralization is sericite-chlorite and carbonate. Chalcopyrite and pyrite content appears to increase with increasing alteration intensity.

These drilling results have demonstrated the presence of broad zones of near surface copper mineralization at the Breton Breccia. The program also confirmed the lateral continuity of copper zones outside of the historical assay models.

Drillhole TR22-001 was drilled to test the northern extension of the Breton Breccia. The hole intersected a short interval of 8.54 meters at 0.26 % Cu and 1.07 g/t Ag from 215 m to 223.54 m.

Drillhole TR22-002 tested the southwestern area of the mineralized breccia. It intersected 52 meters at 0.26 % Cu and 3.51 g/t Ag from 21 m to 73 m, including 14 meters at 0.42 % Cu and 4.49 g/t Ag.

Drillhole TR22-003 was drilled towards the northwestern fringe of the mineralized breccia. It returned grades of 0.29 % Cu and 3.19 g/t Ag over 60 meters from 16 m to 76 m, including an interval of 17 meters at 0.41 % Cu and 6.15 g/t Ag.

Drillhole TR22-005 tested the southwestern part of the mineralization and was intended to drill into the heart of the breccia. This drill encountered historical underground workings and was aborted at approximately 200 meters in depth. This hole was not sampled.

Drillhole TR22-006 is a re-drill of hole TR22-005. This hole’s location was offset 12 meters to the southwest. This hole intersected a shallow and very wide mineralized zone containing 0.32 % Cu and 2.99 g/t Ag over 100.39 meters from 18 m to 118.39 m, including higher grade intervals of 0.58 % Cu and 4.39 g/t Ag over 30 meters and 1.02 % Cu and 8.39 g/t Ag over 7 meters. This drillhole encountered an obstruction at 205 meters and the hole, which bottomed in mineralization, was terminated. The Company plans to investigate alternative drilling options to optimize drill hole locations at the Breton Breccia to avoid future drill bit obstructions.

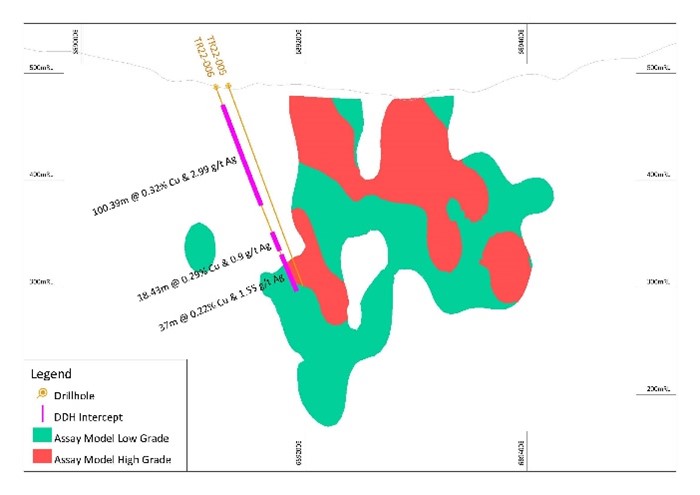

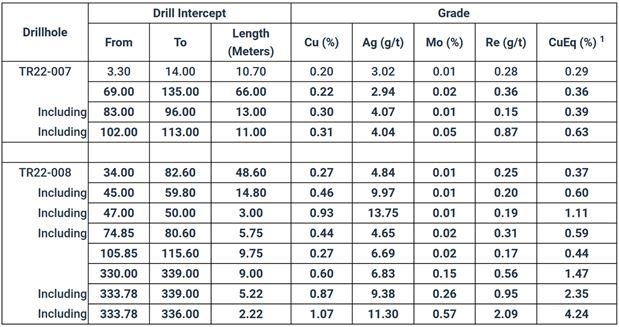

East Breccia Drilling Results

¹ Assumptions used in USD for the copper equivalent calculation are metal prices of $3.45/lb Copper, $20.54/oz Silver, $40.50/kg Molybdenum, $1531/kg Rhenium and recovery is assumed to be 100% as no metallurgical test data is available. The following equation was used to calculate copper equivalence: CuEq = Copper (%) + (Silver (g/t) x 0.0087) + (Molybdenum (%) x 5.32) + (Rhenium (g/t) x 0.02)

East Breccia mineralization is characterized by a chlorite-epidote±sericite-carbonate altered polymictic breccia containing pyrite-pyrrhotite-chalcopyrite mineralization. Mineralization extends to metavolcanic and felsic rocks. High copper mineralization appears to be associated with increasing silver, molybdenum, and rhenium content. At depth, in a metavolcanic host, there is evidence of a structurally controlled higher-grade copper-silver-molybdenum-rhenium zone.

Drilling results have established the presence of near surface copper mineralization with accompanying anomalous silver, molybdenum and rhenium content. It also indicates the potential for higher-grade mineralization related to a feeder structure at depth.

Drillhole TR22-007 tested the northwest extension of the East Breccia mineralization. It intersected a broad zone of copper mineralization at 0.22 % Cu and 2.94 g/t Ag over 66 meters from 69 m to 135 m, including a 13-meter interval containing 0.30 % Cu and 4.07 g/t Ag from 83 m to 96 m.

Drillhole TR22-008 was also drilled to test northwest extension of the East Breccia mineralization. It intersected near surface copper mineralization with best results of 0.27 % Cu and 4.84 g/t Ag over 48.6 meters from 34 m to 82.6 m, including higher grade intervals of 0.46% Cu and 9.97 g/t Ag over 14.80 m from 45 m to 59.80 m and 0.93 % Cu and 13.75 g/t Ag over 3 m from 47 m to 50 m. At depth, the hole also intersected, better grade copper mineralization of 0.60 % Cu and 6.83 g/t Ag with significant amounts of Molybdenum (Mo) and Rhenium (Re) over 9 m from 330 m to 339 m. This interval includes a higher-grade zone of 1.07 % Cu, 11.30 g/t Ag, 0.57 % Mo, and 2.09 g/t Re over 2.22 m from 333.78 m to 336 m.

Current and Future Work Plans

The company is continuing its exploration program to search for the potential intrusive source or sources of the extensive copper mineralization covering the property. Target validation is being conducted by extensive lake and surface geochemical surveys in conjunction with geological mapping, review/modelling of historical diamond drilling data and ground truthing of historical geophysical targets. In the upcoming weeks, the company will announce future exploration/drilling plans for the Fall/Winter program.

Qualified Person

Mr. Augusto Flores IV, P.Geo., a qualified person for the purposes of National Instrument 43-101, has reviewed and approved the technical disclosure contained in this news release.

Quality Assurance and Quality Control (QA/QC)

The Company contracted Ronacher MacKenzie Geoscience Inc. of Sudbury Ontario to establish QA/QC procedures in the handling and assaying of drill core.

QA/QC include the systematic insertion of duplicates, blanks and certified reference materials (CRM), with blanks and CRM making up 10% of the sample stream. Drill core samples are logged, and samples were split into half using a diamond core saw. The other half of the drill cores are stored on site in a safe and secure facility. Half-core samples are labelled, placed in sealed bags and shipped directly to AGAT Laboratories in Timmins, ON, an accredited mineral analysis laboratory. The Company plans to check assay several high-grade sections to verify grade.

For further information, please contact:

Mr. John Timmons

President/CEO and Director

Copper Road Resources Inc.

Cellular: (416) 931 2243

Email: [email protected]

Web: www.copperroad.ca

Copper Road Resources Inc. is a Canadian based explorer engaged in the acquisition, exploration and evaluation of properties for the mining of precious and base metals. The Company is exploring for large copper/gold deposits on the 21,000-hectare Batchewana Bay Project 80 km. north of Sault St. Marie, Ontario, Canada.

Caution Regarding Forward-Looking Information

This news release contains forward-looking information that involves substantial known and unknown risks and uncertainties, most of which are beyond the control of Copper Road. Forward-looking statements include estimates and statements that describe Copper Road Resource’s future plans, objectives or goals, including words to the effect that Copper Road Resources or its management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to Copper Road Resources, the Company provides no assurance that actual results will meet management’s expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, the Company’s objectives, goals or future plans, statements, details of the exploration results, potential mineralization, Copper Road Resource’s treasury, management team and enhanced capital markets profile, the estimation of mineral resources, exploration and mine development plans, timing of the commencement of operations and estimates of market conditions.

Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, failure or inability to complete the Offering on disclosed terms or at all, regulatory approval processes, failure to identify mineral resources, delays in obtaining or failures to obtain required governmental, regulatory, environmental or other project approvals, political risks, inability to fulfill the duty to accommodate First Nations and other indigenous peoples, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital and operating costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, and those risks set out in the Company’s public documents filed on SEDAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Copper Road Resources disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.